The End of Henry Morgan

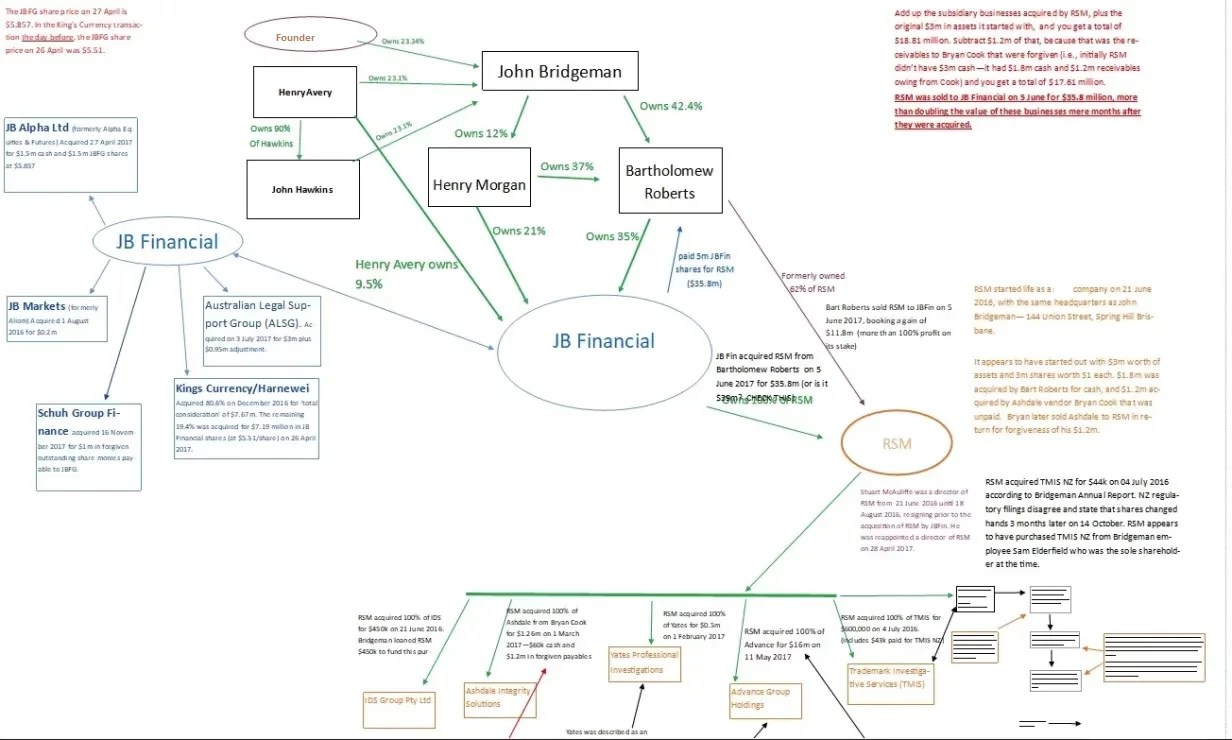

Five years ago, I published a series of reports on a group of “pirate” companies after identifying concerns in public filings. For the first time, here is the full story.

Australian banks & rising rates: Some notes

In the last few years I’ve started looking more and more for possible setups. A “setup” is where there are five or six identifiable moving parts that may or may not align but have the potential to create significant value if they do. I’ve written before about setups at CD Projekt Red and and at …

Halo Technologies IPO (ASX:HAL): Some Thoughts On Risk

I recently reviewed the Halo Technologies IPO (ASX:HAL) prospectuses for its planned listing on the ASX in April 2022. There are several key issues that I’m concerned may deliver suboptimal outcomes for investors. The Setup Halo Technologies provides “online global equities research and trade execution software solution that brings sophisticated institutional-grade analytical frameworks and market …

Metro Bank: Peak Uncertainty

Metro Bank (LON:MTRO) is undergoing a multi-year turnaround under new CEO Daniel Frumkin. Here’s my take on the work so far, and the chance of success.

Fixed Fee Funds Management: So Insane, It Just Might Work

Fixed fee funds management. A look at why it might – and why it mightn’t -work.

Sezzle’s Precipice

After Xinja’s Pivot, I’m coining Sezzle’s Precipice to describe a company that stands on the knife edge of catastrophic failure. Whether Sezzle tips over the eponymous precipice or skates along the top before riding off into the sunset is yet to be seen. (I wrote some preliminary thoughts on the company late last year). After …

Interactive Brokers: A Stock Pitch

I have written about Interactive Brokers (NASDAQ:IBKR) before, most notably in Xinja’s Pivot. During the Covid Crash I purchased it on valuation grounds, but I think there are a lot of fundamental merits to, and opportunity in, the business. I recently pitched the stock and I’ve tidied up my notes to publish here: Stockbroking is …

Blue Ocean Strategy: A Review

I am reading Blue Ocean Strategy (Expanded Edition) by W. Chan Kim and Renee Mauborgne. It is solid gold and I wish I’d read it 10 years ago. The thing that surprises me most here is that nothing in here is “new”. Apart from the case studies (which are excellent), I could not put my …

Airtasker IPO Raises Valuation Questions

The Airtasker IPO is shaping up to be interesting. It’s one of my favourite niche topics – private market valuation meets public market investors. My perception of Airtasker is that there has been a mismatch between perceived growth potential of the business (as measured by valuation) and its actual performance. That disconnect was arrested painfully …

Xinja’s Pivot

I’m coining a new phrase, Xinja’s Pivot, to describe “bad-to-worse” changes in business direction. Mark my words, three years from now it’ll be a hall-of-famer alongside Occam’s Razor and Maslow’s Hammer. Neobanking The thing about neobanks is that if you take the fees out of banking, you take most of the profits out too. What’s …